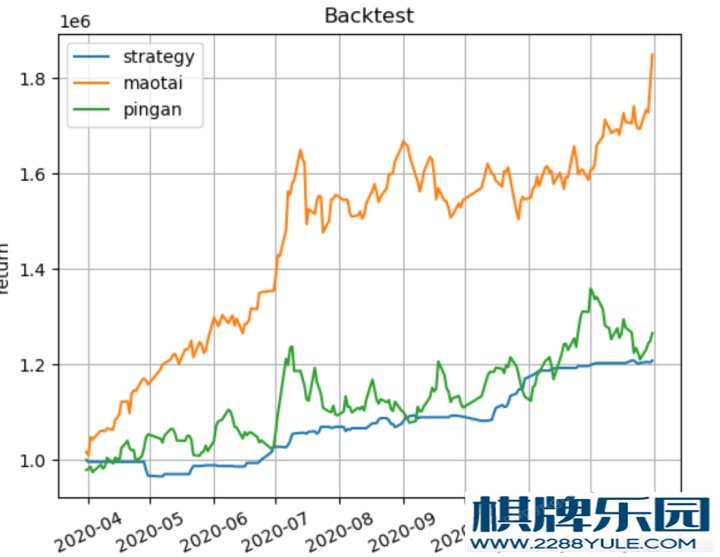

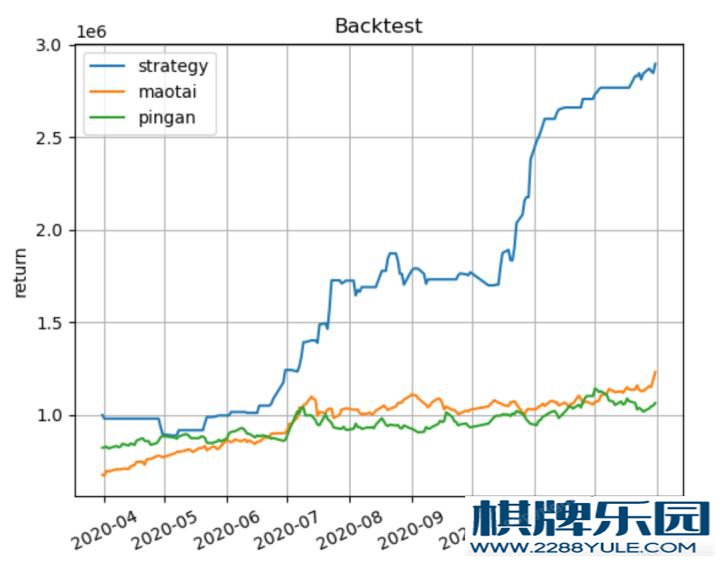

近期回测

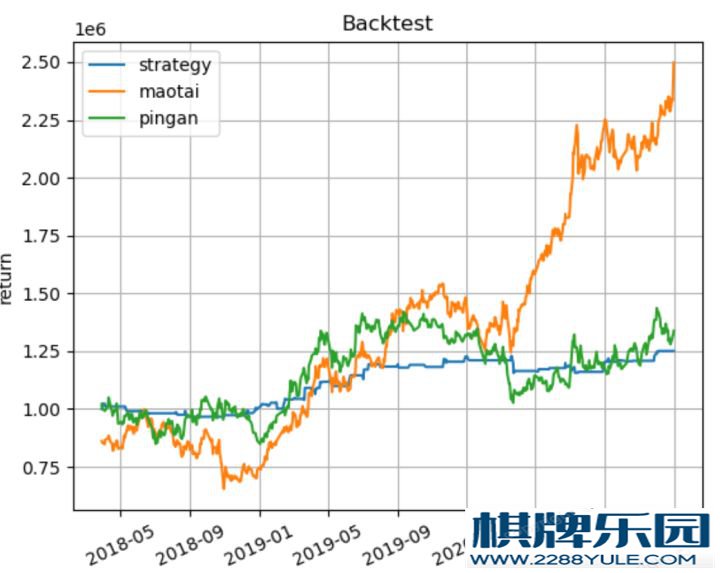

近期回测 过去三年回测

过去三年回测 最大化资金使用率后的回测

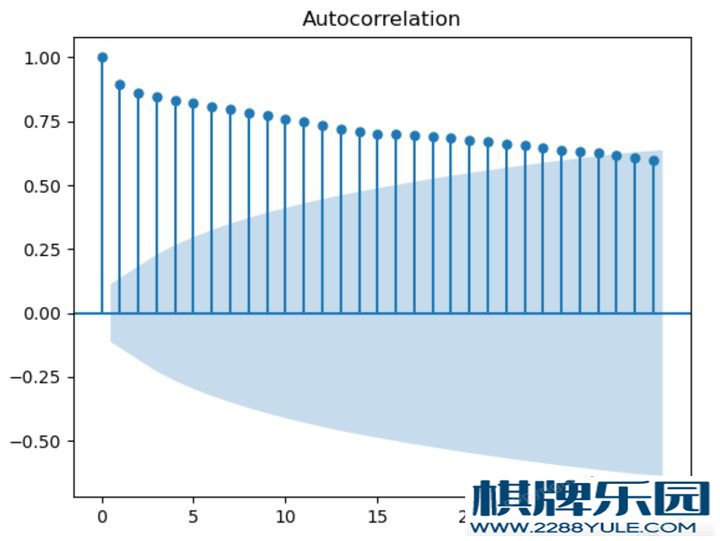

最大化资金使用率后的回测 理论A股上证50的成分股acf时序分析得出,统计显著的非阴影区域中,股价由于事件驱动产生的shock会在一个月内回归。

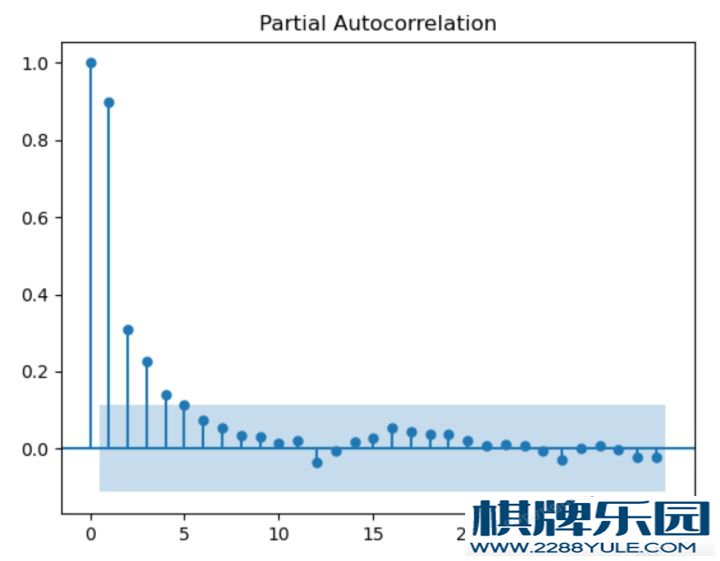

理论A股上证50的成分股acf时序分析得出,统计显著的非阴影区域中,股价由于事件驱动产生的shock会在一个月内回归。 从PACF分析中可以得出shock后每天的统计显著的自相关会持续5天左右。

从PACF分析中可以得出shock后每天的统计显著的自相关会持续5天左右。 建模接下来根据数据理论建模,具有协整性的stock pair,当有shock来临时,做多并持有5天。当作趋势突破因子用,笔者测试的未来回报IC值也是当持仓5天时最高。关于协整性测试我试了以下方法,通过结果和具体信号触发的案例分析得出第三个为最好。具体统计含义此处不详细深入。Engle-GrangerJohansenOLS residual Adfullerdifference unit rootdef cointegration_test(y, x):

ols_result = sm.OLS(y, x).fit()

return adfuller(ols_result.resid)接下来是信号触发机制代码:def find_good_pairs(df):

#df = df.fillna(method='ffill')

#df = df.fillna(method='bfill')

dim = df.shape[1] # number of columns

#pvalue_matrix = np.ones((dim, dim))

#correl_matrix = np.zeros((dim, dim))

keys = df.keys() # index object of df columns

good_pairs = []

short = []

long = []

for i in range(dim):

for j in range(i + 1, dim):

try:

stock1 = df[keys[i]] # first stock

stock2 = df[keys[j]] # second stock

# correlation is about magnitude in short time

correl = np.corrcoef(stock1,stock2)[0,1]

# cointegration is about possibility if stationary over long time

#pvalue = coint(stock1, stock2)[1]

pvalue = cointegration_test(stock1,stock2)[1]

#pvalue_matrix[i, j] = pvalue

#correl_matrix[i, j] = correl

if pvalue < coint_param and correl > corr_param:

good_pairs.append((keys[i], keys[j]))

diff = stock1-stock2

rmean = diff.rolling(rmeanwindow).mean()[-1]

#rmean = diff[-2]

std = np.std(diff[-rmeanwindow:])

if diff[-1] > rmean+2*std:# and diff[-1] < rmean+3*std:

print(f'long {keys[i]}, short {keys[j]}, corr is {correl}, coint is {pvalue}')

if style == 'reversal':

#if stock1[-1] < stock1[-2]:

short.append(keys[i])

#if stock2[-1] > stock2[-2]:

long.append(keys[j])

if style == 'trend':

if (stock1[-1]-stock1[-5])/stock1[-5] < buyhighlimit:

long.append(keys[i])

short.append(keys[j])

elif diff[-1] < rmean-2*std:# and diff[-1] > rmean-3*std:

print(f'long {keys[j]}, short {keys[i]}, corr is {correl}, coint is {pvalue}')

if style == 'reversal':

#if stock2[-1] < stock2[-2]:

short.append(keys[j])

#if stock1[-1] > stock1[-2]:

long.append(keys[i])

if style == 'trend':

if (stock2[-1] - stock2[-5]) / stock2[-5] < buyhighlimit:

long.append(keys[j])

short.append(keys[i])

except:

pass

return good_pairs, set(short), set(long)数据A股日线数据可以从挖地兔取得def get_stock_data(start, end):

ticker_list = ['603986.SH','603501.SH','603288.SH','603259.SH','601995.SH','601899.SH','601888.SH','601857.SH','601818.SH','601688.SH','601668.SH','601628.SH','601601.SH','601398.SH','601336.SH','601318.SH','601288.SH','601211.SH','601166.SH','601138.SH','601088.SH','601066.SH','601012.SH','600918.SH','600893.SH','600887.SH','600837.SH','600809.SH','600745.SH','600703.SH','600690.SH','600588.SH','600585.SH','600570.SH','600547.SH','600519.SH','600438.SH','600309.SH','600276.SH','600196.SH','600104.SH','600050.SH','600048.SH','600036.SH','600031.SH','600030.SH','600028.SH','600016.SH','600009.SH','600000.SH']

ticker_list = ','.join(ticker_list)

data = pd.DataFrame()

daily_df = pro.query('daily',ts_code=ticker_list,start_date=start,end_date=end,fields='ts_code,trade_date,close')

data = pd.concat([data,daily_df],axis=0)

return data

df = pd.DataFrame()

for j in [str("%.2d" % i) for i in range(17,21)]:

for i in [str("%.2d" % i) for i in range(1,13)]:

start = '20'+j+i+'01'

end = '20'+j+i+'31'

df = pd.concat([df,get_stock_data(start,end)],axis=0)

df.columns = ['stock', 'date', 'close']

df = df.pivot_table(index=['date'], columns='stock', values='close')

df.index = df.index.map(lambda x:dt.datetime.strptime(str(x),'%Y%m%d'))参数设置amount = 1.0e6 #起始金额cointwindow = 200 #协整区间最好为一年以上rmeanwindow = 20 #信号触发标准,直接影响信号的多少和质量rebalance = 3 #调仓天数turnoveradj = 1 * rebalance #本金根据调仓天数分配,这样可能导致信号少的是否资金没有完全利用coint_param = 0.05 #协整度参数corr_param = 0.6 #相关性参数buyhighlimit = 0.2 #买入前安全保护阈值以免过高买入style = 'trend' #用统计套利做趋势或者回归绩效分析

建模接下来根据数据理论建模,具有协整性的stock pair,当有shock来临时,做多并持有5天。当作趋势突破因子用,笔者测试的未来回报IC值也是当持仓5天时最高。关于协整性测试我试了以下方法,通过结果和具体信号触发的案例分析得出第三个为最好。具体统计含义此处不详细深入。Engle-GrangerJohansenOLS residual Adfullerdifference unit rootdef cointegration_test(y, x):

ols_result = sm.OLS(y, x).fit()

return adfuller(ols_result.resid)接下来是信号触发机制代码:def find_good_pairs(df):

#df = df.fillna(method='ffill')

#df = df.fillna(method='bfill')

dim = df.shape[1] # number of columns

#pvalue_matrix = np.ones((dim, dim))

#correl_matrix = np.zeros((dim, dim))

keys = df.keys() # index object of df columns

good_pairs = []

short = []

long = []

for i in range(dim):

for j in range(i + 1, dim):

try:

stock1 = df[keys[i]] # first stock

stock2 = df[keys[j]] # second stock

# correlation is about magnitude in short time

correl = np.corrcoef(stock1,stock2)[0,1]

# cointegration is about possibility if stationary over long time

#pvalue = coint(stock1, stock2)[1]

pvalue = cointegration_test(stock1,stock2)[1]

#pvalue_matrix[i, j] = pvalue

#correl_matrix[i, j] = correl

if pvalue < coint_param and correl > corr_param:

good_pairs.append((keys[i], keys[j]))

diff = stock1-stock2

rmean = diff.rolling(rmeanwindow).mean()[-1]

#rmean = diff[-2]

std = np.std(diff[-rmeanwindow:])

if diff[-1] > rmean+2*std:# and diff[-1] < rmean+3*std:

print(f'long {keys[i]}, short {keys[j]}, corr is {correl}, coint is {pvalue}')

if style == 'reversal':

#if stock1[-1] < stock1[-2]:

short.append(keys[i])

#if stock2[-1] > stock2[-2]:

long.append(keys[j])

if style == 'trend':

if (stock1[-1]-stock1[-5])/stock1[-5] < buyhighlimit:

long.append(keys[i])

short.append(keys[j])

elif diff[-1] < rmean-2*std:# and diff[-1] > rmean-3*std:

print(f'long {keys[j]}, short {keys[i]}, corr is {correl}, coint is {pvalue}')

if style == 'reversal':

#if stock2[-1] < stock2[-2]:

short.append(keys[j])

#if stock1[-1] > stock1[-2]:

long.append(keys[i])

if style == 'trend':

if (stock2[-1] - stock2[-5]) / stock2[-5] < buyhighlimit:

long.append(keys[j])

short.append(keys[i])

except:

pass

return good_pairs, set(short), set(long)数据A股日线数据可以从挖地兔取得def get_stock_data(start, end):

ticker_list = ['603986.SH','603501.SH','603288.SH','603259.SH','601995.SH','601899.SH','601888.SH','601857.SH','601818.SH','601688.SH','601668.SH','601628.SH','601601.SH','601398.SH','601336.SH','601318.SH','601288.SH','601211.SH','601166.SH','601138.SH','601088.SH','601066.SH','601012.SH','600918.SH','600893.SH','600887.SH','600837.SH','600809.SH','600745.SH','600703.SH','600690.SH','600588.SH','600585.SH','600570.SH','600547.SH','600519.SH','600438.SH','600309.SH','600276.SH','600196.SH','600104.SH','600050.SH','600048.SH','600036.SH','600031.SH','600030.SH','600028.SH','600016.SH','600009.SH','600000.SH']

ticker_list = ','.join(ticker_list)

data = pd.DataFrame()

daily_df = pro.query('daily',ts_code=ticker_list,start_date=start,end_date=end,fields='ts_code,trade_date,close')

data = pd.concat([data,daily_df],axis=0)

return data

df = pd.DataFrame()

for j in [str("%.2d" % i) for i in range(17,21)]:

for i in [str("%.2d" % i) for i in range(1,13)]:

start = '20'+j+i+'01'

end = '20'+j+i+'31'

df = pd.concat([df,get_stock_data(start,end)],axis=0)

df.columns = ['stock', 'date', 'close']

df = df.pivot_table(index=['date'], columns='stock', values='close')

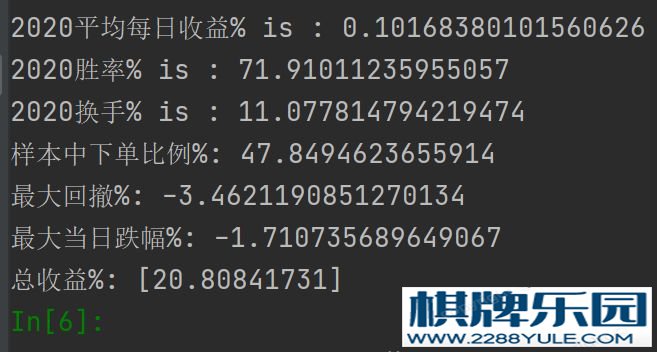

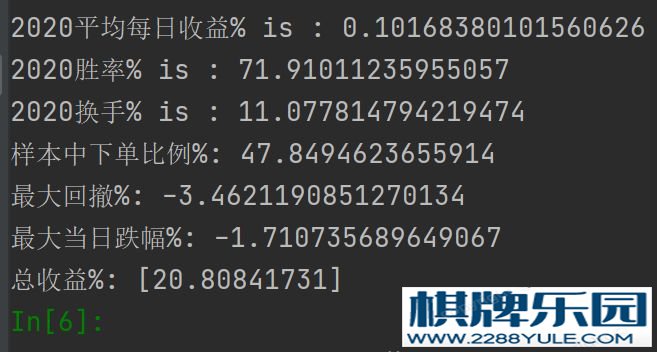

df.index = df.index.map(lambda x:dt.datetime.strptime(str(x),'%Y%m%d'))参数设置amount = 1.0e6 #起始金额cointwindow = 200 #协整区间最好为一年以上rmeanwindow = 20 #信号触发标准,直接影响信号的多少和质量rebalance = 3 #调仓天数turnoveradj = 1 * rebalance #本金根据调仓天数分配,这样可能导致信号少的是否资金没有完全利用coint_param = 0.05 #协整度参数corr_param = 0.6 #相关性参数buyhighlimit = 0.2 #买入前安全保护阈值以免过高买入style = 'trend' #用统计套利做趋势或者回归绩效分析 平均的每日收益包括信号不触发的时间。换手率指的是平均每天需要调仓和整体暴露的比例。下单比例说明一年里平均两天触发一次信号。最大回撤是

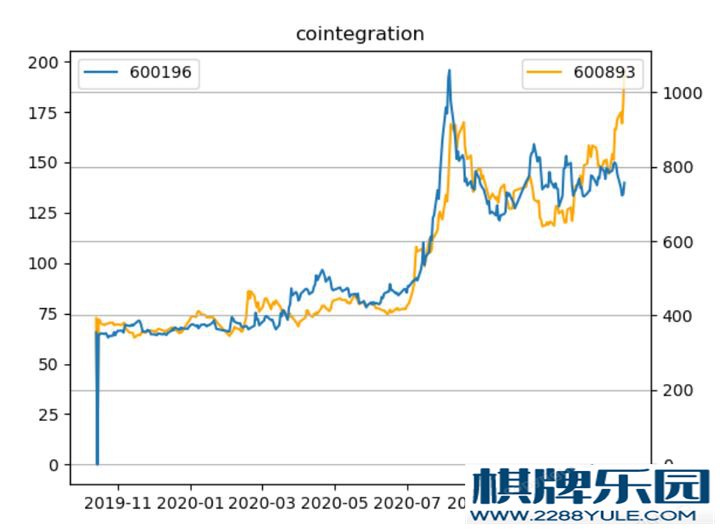

平均的每日收益包括信号不触发的时间。换手率指的是平均每天需要调仓和整体暴露的比例。下单比例说明一年里平均两天触发一次信号。最大回撤是  的含义,就是在盈利基础上最大的回撤。对于如此高胜率的解释是当配对股票产生日k线价格的分歧后,将会带来趋势性的突破。

的含义,就是在盈利基础上最大的回撤。对于如此高胜率的解释是当配对股票产生日k线价格的分歧后,将会带来趋势性的突破。

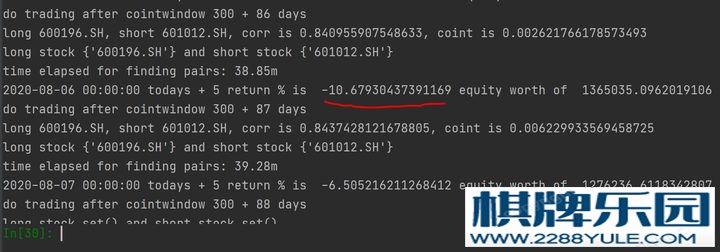

但是在大概率的背后也会有像下图的突破性急速反转。因此在绩效分析的时候需要对特定情况分析,然后改进策略保护机制。

但是在大概率的背后也会有像下图的突破性急速反转。因此在绩效分析的时候需要对特定情况分析,然后改进策略保护机制。

文末留一个悬念给大家,怎么找突破还是回归的方法可以看下文末的评论区~

文末留一个悬念给大家,怎么找突破还是回归的方法可以看下文末的评论区~

在竞技性比较高的麻将规则如国标麻将、日本麻将中,可能高手和一个平均水平选手打200 手牌左右就能看出显著性差异;但在推倒和规则中,可能需要 2000 甚至更多手牌才能区分高手和平均水平选手。

存在四张全局变量“宝牌”,持有者可以根据需要自行跨类型赋值。其中“中”每次初始化时被重新赋值棋牌游戏大厅,值为“宝牌”的初始值。